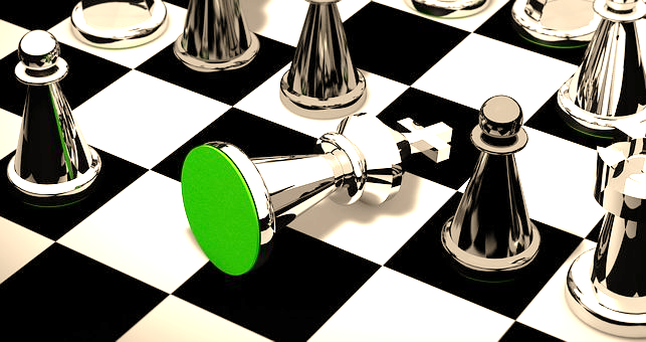

“AND JUST LIKE THAT” The Reboot of Sex and the City and the reboot of Financial Institutions’ Insurance Distribution is getting a lot of media coverage lately. Financial Institutions (FI) Insurance Distribution, just like SATC is once more a “hot topic” of conversation in financial services. For the non-initiated, this new version of SATC begins 10 years after their last movie in 2010. The SATC ladies have come back older, trying to navigate the changed culture and managing problems they never even dreamed they would encounter. This also true for FI wrestling with their everchanging landscape; managing the quest for scale, seeking excellence in customer experience, integrating DEI and understanding the impact of ESG on their brand, are just a few elements that keep FI executives up at night. Since the pandemic has morphed and will probably continue to do so, this pandemic-induced growth in everything digital to enhance customer retention and the need for non-interest fee income, have also buoyed FI insurance distribution. The form this resurgence takes is immaterial; whether it is mergers, acquisitions, organic development, outsourced, or new concepts designed for the smaller institutions, FI insurance distribution is thriving. To give a bit of context: 1. “In 2021, broker mergers and acquisitions hit a fifth straight record year in the insurance distribution sector, with 798 transactions announced as of Jan. 3, 2022, a 12.2% increase compared with the 2020 announced deal total of 711.” (1) The prominent players are private equity backed; however, FI and carriers are still in the acquisition mix. One explanation for FI’s continuing interest is the ability to purchase the smaller regionals that are overlooked by the public brokers or equity -backed players. Cross selling to the agency’s insurance clients continues to be attractive. 2. “Insured losses of $44 billion from COVID-19, so far represent the third largest cost to insurers of any catastrophe, behind Hurricane Katrina and the 9/11 attacks.” (2) Covid elevated the need for better life insurance, accident and sickness coverage and critical illness coverage for the first time in the public’s eyes. Third quarter YTD new sales for workplace life Insurance, disability income and supplemental health increased significantly in 2021 with growth rates ranging from 4 to 12 percent. (3) 3. Again, just like our SATC heroines on screen that are reinventing new careers, the fintech and insurtech revolution continues to evolve. Global insurtechs have raised a whopping $10.5 billion across 427 deals in 3Q’21 and this funding figure is already 48% greater than 2020’s year-end total. (4) Fintechs add to this number by blowing past 2020 total funding by 3Q21 for a total of $94.7 billion, a 96% increase. (5) 4. I was one of the original Board Members of the American Bankers Insurance Association. One of the key components of the Association was the annual conference that brought together FI interested in insurance distribution. The Conference has not happened in the last couple of years. However, in 2021, a consortium of the American Bankers Association, North Carolina Bankers Association (where I recently helped to architect their insurance distribution strategy) has been formed with Stathis-Mittel Business Intelligence as managers. This leadership community will focus on helping FI to fulfill the insurance protection needs of their clients, and annual conferences are planned. AND JUST LIKE THAT, these four trends are an indication that FI insurance distribution is embracing transformation as advocated by Socrates, “The secret of change is to focus all your energy, not on fighting the old, but on building the new.” I look forward to all the changes we will see in the FI industry in 2022 and, of course, the new episodes of Sex and the City! What do your think? Reach out to me at [email protected] , or 203.226.2645 with comments or questions. (1) Business Insurance January 7, 2022, Marsh Berry Capital (2) Howden from Reuters quoted in Business Insurance, January 4, 2022 (3) LIMRA’s U.S. Workplace Life, Disability, and Supplemental Health Insurance Sales Surveys, Third Quarter 2021. (4) CB insights Insurtech Investing 3Q Report (5) CB Insights State of Fintech Q3’21 Report What Does Chess And The Question “Why Do You Rob Banks?” Have In Common? As a world-renowned chess master, Gerry Kasparov was used to winning. In fact, he simultaneously beat 32 computers in 1985. Just 12 years later, in 1997 his life changed dramatically when he was crushed by IBM’s Big Blue $10 Million computer. Today his new book, Deep Thinking, Where Machine Intelligence Ends and Human Creativity Begins promotes embracing technology so it can enhance not just our chess game, but our business and personal lives. While I am a conscious subscriber to the elements of technology that enhance my life, I am becoming more cautious about the use of Artificial Intelligence (AI) in my day-to-day interactions with technology. As long as humans were still programing the code that runs the computer programs, I felt more comfortable that the outcomes have a level of integrity and a modicum of “humaneness”. However, I feel uncomfortable when the programs program themselves. With the advent of neural networks and machine learning algorithms that mimic how the human neurons interact in our brains, the machines are now writing the rules, and artificial intelligence (AI) is commonplace, even when we are unaware of its presence. For many years, it was kind of simple; programmers wrote the code and the machine would articulate the code in a human-friendly fashion. This felt right because we were in control of the outcomes as we did the programming. Of course, this is rather simplistic thinking when factoring in the motivations of “hackers and criminals” but cyber-crime is just one very negative byproduct of our digital dependence. Back in the 50’s, when the notorious bank robber Willie Sutton, was asked, “Why do you rob banks?” He purportedly answered, “Because that is where the money is.” In the near future, banks can be robbed and the only entity that may be able to answer that question is an “algorithm” that no one understands. |

|

RSS Feed

RSS Feed